Original Medicare covers no routine hearing care. Medicare Advantage may include $500 - $2,000 per-ear allowances, while Medigap offers nationwide doctor choice but zero aid help. Budget or buy stand-alone coverage to avoid $2,000 - $7,000 bills.

Because saying "Huh?" shouldn't be your new hobby.

Medicare Coverage? • MA Hearing Perks • Medigap & Hearing • Stand-Alone Options • Which Plan Fits? • FAQ • Pick a Plan with Confidence

New to Medicare and wondering if Medicare covers hearing aids?

Nearly 1 in 3 adults 65–74 and almost half of folks 75 + live with hearing loss. Untreated, it’s linked to depression, loneliness, social withdrawal, and even cognitive decline, including dementia. It can affect your mood, memory, relationships, and even your sense of safety. Translation: hearing well = living well.

Yet Original Medicare pays $0 for routine exams or hearing aids unless a doctor orders a diagnostic test for a medical condition. And decent aids? Those will cost you $2k–$7k per ear plus fittings. That math gets loud fast.

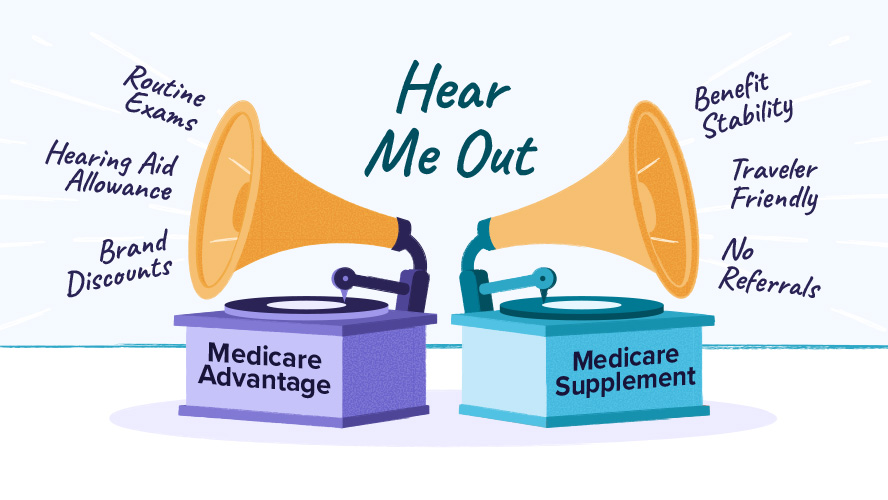

Before you get caught off guard, let’s break down how Medicare Advantage and Medicare Supplement (Medigap) plans handle hearing care, so when you first enroll in a Medicare plan you can choose the option that keeps you tuned‑in today and tomorrow.

How much help do Medicare Advantage plans give?

Think of Medicare Advantage plans as a Medicare playlist remixed by Spotify—same core tracks (Parts A & B) plus new ones like drugs, dental, and yes, hearing.

🎧 It can be music to your ears

- Routine exam: often $0 - $40 copay

- Allowance: $500 - $2,000 per ear toward aids (varies by plan)

- Fittings + follow-ups included so your new tech actually works

- Brand discounts via preferred manufacturers

- Annual checkups for ongoing support as your hearing changes

🔊 But check the volume

- Networks: love your audiologist? Make sure they're in-network

- Allowance caps: $1k doesn't feel like much for a $3k device

- Prior authorization: paperwork approval needed before purchase

- Annual plan tweaks: benefits can change or even vanish next year

Bottom line: Great hearing perks if the network and cap fit your lifestyle.

Do Medigap plans pay for hearing exams?

Medicare Supplement (aka Medigap) plans plug Medicare's cost gaps—deductibles, coinsurance—so you pay little to nothing for covered medical care.

✔️ Why you might love it

- Freedom: see any Medicare-accepting provider nationwide

- Stability: benefits are the same no matter the carrier and they don't shift annually

- No referrals: go straight to specialists

- Traveler-friendly: snowbirds and frequent fliers rejoice

❌ Why your ears might protest

If Medicare doesn't cover it, Medigap doesn't either. That means zero help for hearing aids or routine exams. You'll have to budget separately for:

- 1. Stand-alone hearing insurance (premiums vary)

- 2. Discount clubs: pay ~$100 - $200/year for negotiated pricing

- 3. VA benefits if you're a veteran (free high-tech aids for those who qualify)

Bottom line: Rock-solid freedom and predictable costs, but that freedom comes with a separate cost for hearing benefits and aids.

| Plan type | Exam copay | Aid allowance | Network? | Annual change risk |

| Medicare Advantage | $0 - $40 | $500 - $2,000 per ear (varies by plan) | Yes, must stay in-network | High: benefits, caps, and networks can change every year |

| Medicare Supplement (Medigap) | Not covered (pay full price) | $0; no built-in aid help | Any Medicare-accepting provider nationwide for medical care | Low: core medical benefits are standardized and rarely change |

Healthcare freedom vs. hearing help: Which one is playing your song?

So if you're new to Medicare, how do you decide between some hearing benefits but with less provider flexibility vs. consistent coverage wherever you want it but with no hearing benefits included? With our easy-to-follow question guide.

| 💭 Ask yourself... | ✅ If you answer Yes... | 👉 You might prefer |

| Do I need hearing aid coverage now? | Yes, I want help paying for hearing aids | Medicare Advantage |

| Can I budget for hearing care myself? | Yes, I can pay out-of-pocket if needed. | Medicare Supplement |

| Am I okay with using a network of doctors? | Yes, I don't mind sticking to plan-approved providers. | Medicare Advantage |

| Do I want the freedom to see any doctor who takes Medicare? | Yes, I don't want to deal with networks. | Medicare Supplement |

| Will I be traveling a lot or living in multiple places? | Yes, I'm a snowbird, RV traveler, or visit family in other states. | Medicare Supplement |

| Am I okay with benefits possibly changing each year? | Yes, I'll shop around and compare plans annually. | Medicare Advantage |

| Do I prefer stable, predictable coverage? | Yes, I want long-term consistency. | Medicare Supplement |

What stand-alone insurance fills the gap?

If you've decided on a Medicare Supplement plan—or even a Medicare Advantage plan with limited hearing benefits—you still have options to help cover your hearing needs.

Stand-Alone Hearing Insurance

| 👍 Pros | 👎 Cons |

| Helps pay for routine exams, aids, fittings, and follow-ups | Premiums add $30 - $60/mo to expenses |

| Predictable monthly premium vs. big one-time bill | Caps and networks vary—read the fine print |

| Several coverage levels to match your budget | May leave a sizable share on pricey devices |

Hearing Discount Programs (not insurance)

| 👍 Pros | 👎 Cons |

| Low annual fee (~$100 - $200) for instant savings | You may pay the remaining balance out of pocket |

| Negotiated discounts on exams, aids, batteries, services | Discount size depends on provider participation |

| No underwriting or claims to file | No protection against sudden price hikes |

Employer or Retiree Plans with Hearing Benefits

| 👍 Pros | 👎 Cons |

| Some retiree plans offer free exams or partial aid coverage | Benefits differ widely—must verify every year |

| No extra policy to manage if already enrolled | Coverage can shrink or disappear if the plan changes |

| Good option for union or large-company retirees | Not available to most self-employed or small-company workers |

Veteran Affairs (VA) Hearing Coverage

| 👍 Pros | 👎 Cons |

| Comprehensive exams, fittings, and high-tech aids often free | Only for veterans enrolled in VA healthcare with documented need |

| Robust audiology network and follow-up care | Must use VA facilities—travel or wait times apply |

| Outperforms many private plans if you qualify | Eligibility process and paperwork can be lengthy |

Nonprofit & Manufacturer Assistance

| 👍 Pros | 👎 Cons |

| Grants, rebates, and low- or no-interest financing options | Funding and inventory vary; not guaranteed every year |

| Refurbished aids or sliding-scale pricing cut costs dramatically | Applications and proof-of-need paperwork required |

| Resources like the Hearing Loss Association of America (HLAA) and Starkey Hearing Foundation are easy starting points | Limited choice of models or brands in some programs |

Oh look, another helpful chart!

Hearing help beyond Medicare: Know your options

| Stand-Alone Hearing Insurance & Discount Programs | Employer or Retiree Plans with Hearing Benefits | Veterans Affairs (VA) Hearing Coverage |

| Covers: exams, hearing aids, fitting, follow-ups | Some retiree health plans include: free annual hearing tests, partial/full hearing aid coverage | For eligible veterans in the VA healthcare system |

| Insurance: monthly premiums vary by provider & benefits | 📞 Call your plan administrator to confirm benefits | Includes: free hearing exams, fittings, modern hearing aids, batteries & maintenance |

|

Discount programs: pay a small fee for access to reduced rates on: exams, hearing aids, batteries, services |

✨ Highly comprehensive—often better than Medicare coverage | |

| 👌 Good for those needing mid-to-high-end hearing devices |

Wrapping it up—which beat fits your ears?

Medicare Advantage gives you built-in hearing perks but ties you to networks and yearly benefit changes, while Medigap lets you roam the country but leaves hearing aids on your dime. Either way, doing nothing can cost you $2k - $7k per ear and a chunk of your social life.

If you crave convenience 👉 Shop MA plans, double-check the allowance, and make sure your audiologist is in network.

If you value freedom 👉 Pair Medigap with a stand-alone hearing policy or budget for aids yourself, knowing the rest of your medical bills stay predictable.

Whichever rhythm feels right, remember:

- Hearing well is linked to better mood, memory, and even brain health.

- Plan details matter more than plan labels—always read the fine print.

Hearing Care FAQ

How much can a Medicare Advantage plan contribute toward hearing aids?

Most Medicare Advantage plans offer $500 - $2,000 per ear every one to three years, plus discounted fittings.

Does Medigap cover routine hearing exams?

No. Medigap only fills Original Medicare cost gaps. Because Medicare excludes routine hearing care, Medigap pays $0 toward exams, fittings, or devices. Users typically buy a separate hearing policy or pay cash.

What are stand-alone hearing insurance or discount programs?

Stand-alone policies charge roughly $30 - $60 per month and cover exams plus part of hearing aid costs. Discount clubs cost about $100 - $200 per year and negotiate lower prices but leave you to pay the balance.

Is Medicare Advantage or Medigap better for hearing coverage?

Choose Medicare Advantage if you want built-in hearing benefits and can stay in-network. Choose Medigap if nationwide doctor freedom matters more and you are willing to pay separately for hearing aids.

With ALEX® you can hear the world (and pick a plan) with confidence

No sales pitch, no robo‑calls—just straight talk that helps you pick a plan when you first enroll in Medicare that you’ll still love when the volume is low, and the restaurant is loud.

Because the punchlines, playlists, and “I love yous” are too important to miss.

Hear the difference for yourself: try ALEX and tune in to a clearer Medicare choice.

RO4554001